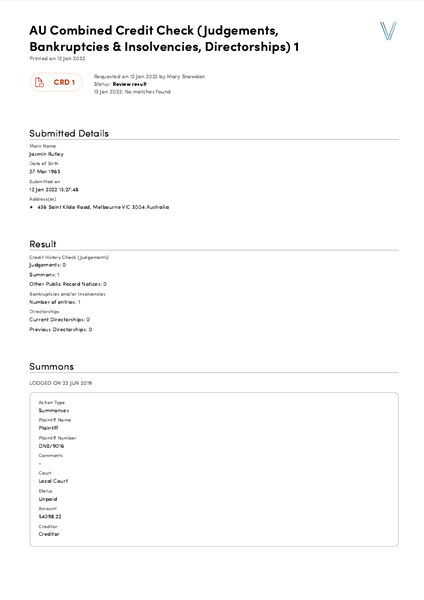

A Credit check will include the following information:

- The individual's details, like name and date of birth

- Any judgements held against the individual

- Summons relating to the individual with accompanying information

- Public record notices and related details pertaining to them

- Bankruptcies filed, including but not limited to the number of bankruptcies, the reference number, the date of the declaration, and any related comments

- Directorship positions, including but not limited to the number of directorships held, details about the company the individual was a director of, and dates of appointment and dissolution